Sara Blogger

January 29, 2021

If you have more than £23,250 in total assets or would rather not have a financial assessment or needs assessment to check your eligibility for funding, you may choose to pay for care yourself. However, it is still possible to get some funding for care even if you do have more savings.

Below, we clarify how much it costs to receive care in your own home. We will also lay out the options that are available to help you make your care budget go further when paying for your care independently.

The cost of at-home care

According to the NHS, at-home hourly care through an agency can typically cost £20 per hour, this varies based on your geographical location. Depending on the level of care needed, a live-in agency carer can cost between £650 - £1,600 a week, on average.

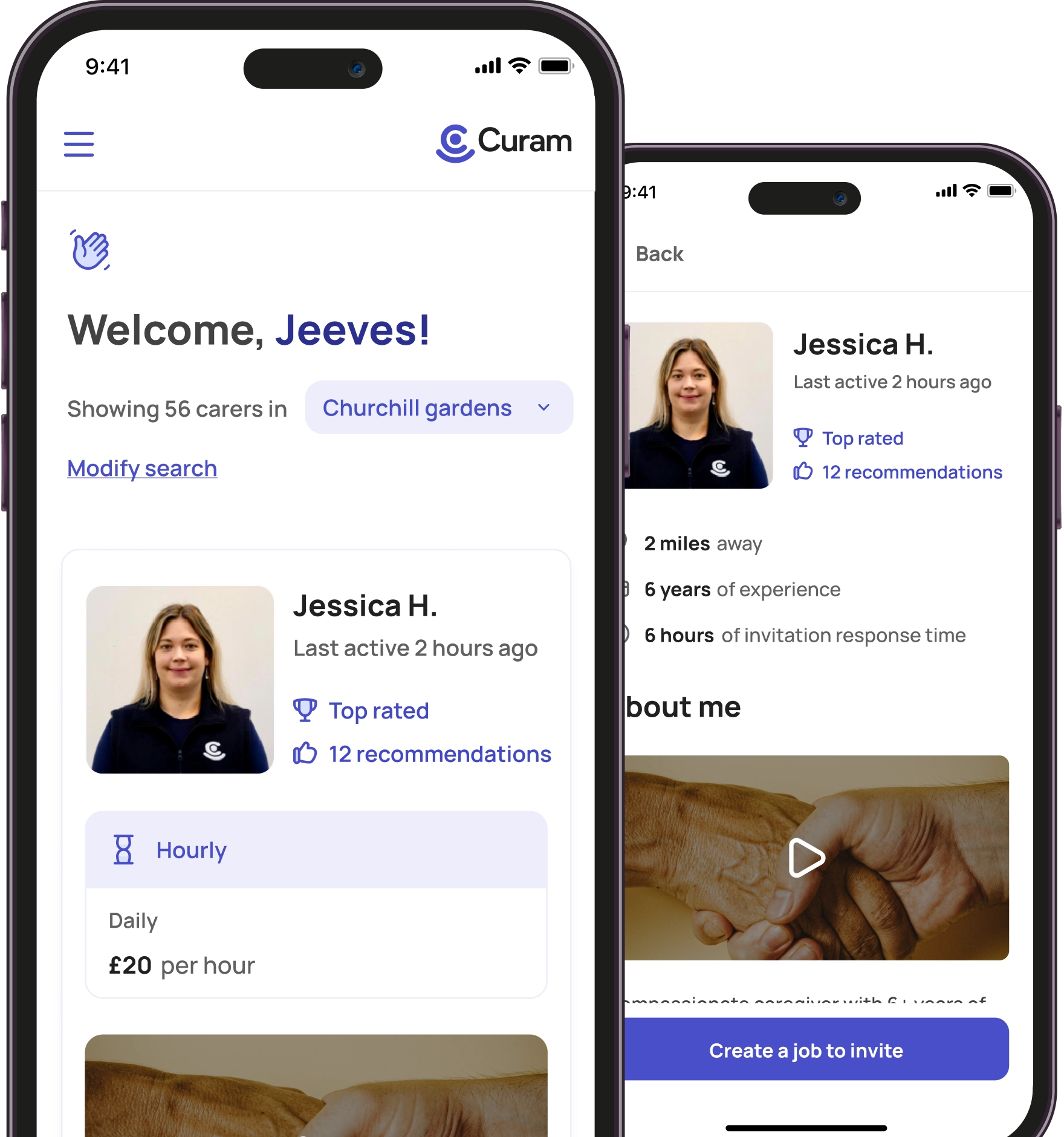

With Curam, you only pay for the care delivered, there are no joining fees or subscription fees. This can help keep your care costs down, and make your precious savings stretch further. Curam carers’ fees vary depending on their experience and your care requirements, you can expect to pay the following:

· Hourly Care ranges from £12-£16 per hour.

· Overnight Care: Overnight care typically costs a fixed rate of £90 per shift, or £14-£18 hourly for waking night care.

· Costs of live-in care begin at £120 per day or an average of £800 per week.

Prices can be negotiated with the carer and carer’s rates include Curam’s fees.

How to make your care budget go further

As well as taking advantage of Curam's lower fees (on average 10% less and the lowest in the sector), there are other options for making your savings go further when paying for care. In addition, if you start to run out of savings, it is worth considering the following options to help you fund care costs.

Here are 4 things you can do to get financial support, even when you have savings and are paying for your own care:

1. Non-means-tested benefits

2. NHS Continuing Healthcare funding

3. Equipment and devices on the NHS

4. Equity release

1. Non-means tested benefits

If you have savings, you may not be eligible for some government benefits as a lot of benefits are means-tested. However, there are some benefits that are not means-tested. This means that you may still be eligible for them as eligibility is not based on a person’s financial situation or assets.

The money you get from benefits can be put towards your care costs and help you stretch your care budget further. Here are 8 government benefits which are not based on someone’s financial situation:

· Attendance Allowance

· Bereavement Benefits

· Disability Living Allowance for Children (DLA)

· Carer’s Allowance

· Personal Independence Payment (PIP)

· Statutory Sick Pay

· Furlough Scheme

· War Widow(er)’s Pension

2. NHS Continuing Healthcare funding

NHS Continuing Healthcare (NHS CHC) is not means-tested. You may be entitled to NHS CHC funding if you have been to hospital and you need a carer to support you while recovering from an illness, operation or accident. If someone’s post-hospital care mean they are eligible, then they can receive fully funded care.

3. Home adaptations and devices on the NHS

If a small piece of equipment or home adaptation costs less than £1000, the NHS may pay for it . Assistive devices and home adaptations can help someone with daily tasks and improve independence. Whilst assistive devices and home adaptations do not replace the work of a carer, they can make living at home easier. It is therefore worth saving money on them so that you can make your savings last longer.

4. Equity Release

If you are running out of savings and need to access funds to pay for care, it is a good idea to check your eligibility for benefits as you may now be eligible for means-tested benefits. If you still need further finances, you can consider equity release. Only people above the age of 55 are eligible to take out equity release, and it should not be done too early as you must make sure you have the funds needed for care in later life.

Equity release describes the financial process that lets people access the money that is tied up in their house. You can take out a sum of money and/or several payments as equity release. There are 2 possible ways of taking out equity release:

· Lifetime mortgage

· Home reversion

What is a lifetime mortgage for equity release?

A lifetime mortgage is where a person borrows money that is secured on their home. Most people take out a lifetime mortgage when they take out equity release. Lifetime mortgages vary, and different lenders offer different deals. You have to be 55 or over to take out a lifetime mortgage.

What is home reversion for equity release?

Home reversion is when you sell a part of your house to a home reversion provider. You will get money in exchange and you have the right to live in the home for the rest of your life, as long as you keep it maintained and insured. When the house is sold, the money from the sale is divided up between the remaining owners of the house, according to the percentage of the home that still belongs to the person who lives there or the people that have inherited it. Some home reversion providers only allow people that are at least 60 or 65 years old to take out equity release.

Things to be careful about with equity release

Equity release can help you fund care if you are running out of savings. However, you should be careful when deciding whether to take equity release, this is because:

· The interest rate is higher on a lifetime mortgage than on an ordinary mortgage

· Debts can grow faster

· Home reversions only give you 20-60% of the market value of your property

Support for people who are self-funding care

Do you know someone who is preparing to fund their own care and is looking to hire a carer? We want to make sure that you find the best carer for you, a friend or a loved one. You can hire a Curam carer by creating a job ad on our website or by downloading the Curam app.

If you need help with self-funding care, or you need financial advice, you can find a specialist care fees adviser in your area with:

· PayingForCare, a free information service for older people

· The Society of Later Life Advisers (SOLLA) on 0333 2020 454

If you would like to know more about funding your own care, you can find out more information and get advice from:

· Age UK on freephone 0800 169 6565

· Independent Age on freephone 0800 319 6789

· The Money Advice Service on freephone 0800 138 7777

Back

Back