Curam Team

June 11, 2021

Finding care that suits your needs and budget should be simple, but with so many different options and price tags available, it can feel overwhelming. This guide will help you get a better understanding of the average costs of the different types of care, as well as the funding that could be available to you.

Before calculating the possible cost of care for you or your loved one, it can be beneficial to have a care needs assessment carried out. This ascertains exactly the type of care a person requires. You can find out more about this in our guide to care needs assessments.

Sections

-

The costs of live-in care explained

-

The costs of residential, nursing and assisted living care explained

-

A breakdown of the average costs of care - at a glance

-

Where to start with funding care

1 - The costs of live-in care explained

What in-home care options are available?

Trying to calculate the cost of care can be a daunting and sometimes a confusing task. Knowing what to look for can help inform your decision to ensure you find the most cost-effective way of paying for care, while also employing a reliable, safe and experienced carer.

The type of in-home care required is largely based on two factors:

• The specialist skills required by the carer. For example, a carer who specialises in caring for people with dementia or a spinal injury

• The length of time care is required for

When investigating the cost of in-home care, your starting point should be the time period you require the carer for. In-home care can be flexible and the cost can suit any budget - as you only pay for the services you need, when you need them.

How many hours will an in-home carer work?

You choose the amount of time you need a carer for. The carer’s costs can be charged in the following time brackets:

• Hourly care: Receiving care at times which suit your needs and fit around your lifestyle.

• Live-in care: A carer lives in your home, 24 hours a day at select days during the week.

• Overnight care: A carer is present between 8pm-8am.

• Respite care: Short term care which replaces that of a spouse, friend or family member. This could fall into any of the previously mentioned time periods.

What are the costs of the different types of in-home care?

Let’s take a look at the average costs of the different time periods of care available. Do be mindful that where you’re based in the UK will have an impact on costs, as the cost of living, like house prices for example, vary depending on your geographical location.

The costs of live-in care

Typically, a live-in carer from a home care agency can cost from £650 to £1000 a week. This can rise to as much as £1600* a week if you need a lot of care.

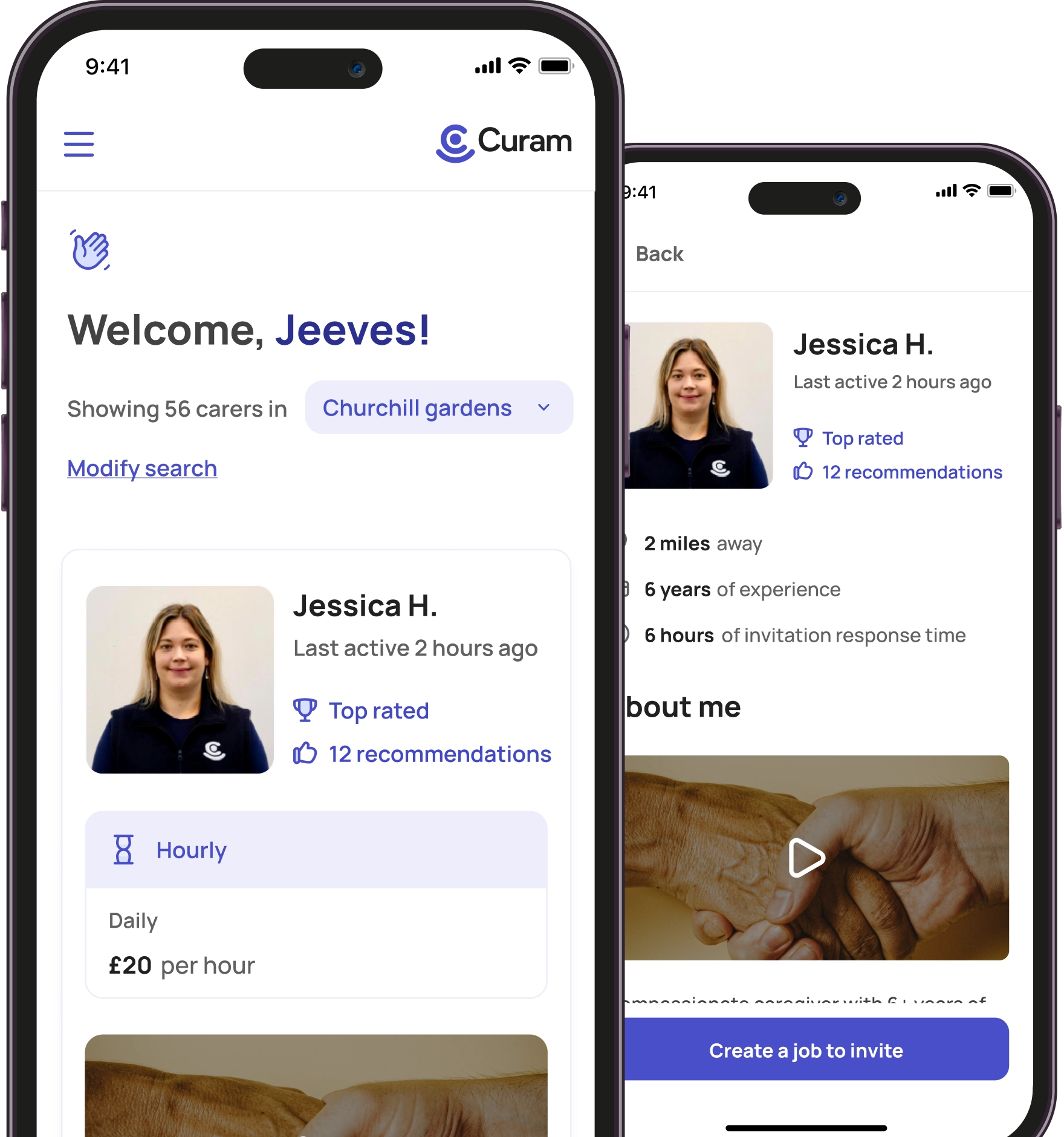

By comparison, a carer, through Curam charges an average of £120 per day or £800 per week for live-in care. What makes Curam different is that we connect self-employed carers with clients. We ensure the carers are fully vetted and manage all the admin including insurance, service agreements, invoices and a secure payment system. This allows us to keep our fees low at just 12.5%+VAT.

The costs of hourly in-home care

The most common form of in-home care is hourly care. For many people, living independently means receiving help with certain day-to-day tasks.

• Average hourly care rates in the UK for private clients are typically around £20 per hour, as they include contract fees and administrative charges. Councils usually pay around £17 per hour.

• Average hourly fees for a home carer with Curam ranges between £13 - £17 per hour.

There are many reasons people choose in-home hourly care. Usually it can be to help with tasks such as, help with personal hygiene, getting dressed or help with shopping, cooking meals or offering respite for a partner or family member.

Finding a reliable, highly skilled and good value carer is worth a great deal. Consider that an evening routine of eating, washing, dressing and being helped into bed can take up to 2 hours every day. Over a month, that figure adds up to approximately £900.

A carer through Curam is paid directly and individual rates are negotiable - helping you save on every hour of care needed, while receiving quality care.

The cost of overnight care

An overnight carer can provide assistance, reassurance and safety for elderly people during the night.

There are two common types of overnight carer, sleeping care and waking night care. A sleeping night carer usually sleeps through the night, but is available when it is required. A waking night carer remains awake throughout the night to assist the person’s needs. The costs of overnight care reflect the different needs and requirements.

• Average carer fees are £90 per a night, or £13 - £17 an hour for waking care through Curam

• Agency carers charge up to £150 a night hourly rates start at £20 an hour for waking care.

What’s the difference between Curam and a home care agency?

We do things differently. With Curam, the carers are self-employed. There are no joining fees and the carers charge rates include Curam’s fee of 12.5%+VAT which covers the cost of their insurance, easy-to-use service agreements and a hassle-free payment system. This means that the client pays less than an agency and the carer receives a higher wage. You also choose and interview the carer before you hire them.

In-home care respects independence. It is tailored to each individual, while they live in the comfort of their own home. Receiving care at home can also be a safer and more cost-effective alternative to a care home.

Common questions to ask when considering the cost of in-home care

• Are there agency administration fees? Or joining fees to consider?

• Is your carer paid directly or through a third party?

• Can you choose your carer?

• Is your carer local or will you have to pay for transport costs?

• Do you have specialist healthcare needs such as dementia or physical disabilities?

• Do you need occasional hourly care, respite care or overnight care

2 - The costs of residential, nursing and assisted living care explained

Leaving your home for a residential or nursing care home is sometimes the only and safest option for some people. A care plan may recommend this after your health assessment.

What are the costs of care homes and residential care?

Care homes are sometimes referred to as residential homes. The average costs vary across the UK as accommodation options and facilities differ.

A recent study showed a basic residential care home package in England costs between £696 to £849 a week. A council will typically fund up to £596 a week if the person is eligible to receive funding.

The cost of care has been affected by costs associated with social distancing, PPE and shielding measures. By contrast, in-home care is often cheaper, covering the same services and can be delivered safely in your home. A specialist carer with Curam costs on average between £13 - £17 an hour depending on your location.

What do the costs of residential care homes cover?

A residential care home will provide accommodation, personal care, medical care and social care to the people who need that extra support each day.

The fees for residential care cover:

• A private bedroom, studio or suite

• Personal care such as washing, dressing, toileting

• Taking medication, changing dressings

• Social activities such as quizzes, day trips, clubs for hobbies

The process is similar to that of moving house. You need to carry out a search, view and then decide which home is the best fit.

Cost of Nursing Homes

A nursing home is for residents who require round-the-clock by registered nurses. Understandably this comes at a significantly higher cost compared with residential and in-home care.

Nursing care costs between £969 and £1,075 per week. Depending on your eligibility, English councils fund on average £764 a week for nursing care.

What do the costs nursing homes cover?

• Care is provided 24 hours a day by Registered Nurses

• Most residents need support with medication, intravenous treatments, dressings and wound care

• Some residents are vulnerable at night needing help to manage symptoms of advanced dementia conditions.

Assisted Living Community costs

Assisted living communities allow residents to live independently, and access care 24 hours a day.

What does assisted living cost?

You are required to either buy or rent assisted living accommodation and the cost will vary based on the facilities, size and geographical location.

Smaller homes with standard facilities cost approximately £500 a week but larger homes with more amenities could cost up to £2,000 a week. It’s essential to check what is and isn’t included in these costs.

It’s really like the housing market. The more facilities, the higher the cost. But versus a care home, assisted living communities should be cheaper.

Costs to consider when reviewing assisted living accommodation:

• Is care included in the cost or is this extra?

• Location in the UK - North vs South England house prices vary greatly

• Bills - check if utilities, council tax and water rates are included

• Lease length and costs to the freeholder - if it’s a rental property

• Purchase costs - if it is a freehold property

• Service charges for site, grounds and facilities maintenance

• Joining and exit fees

• Charges for domestic care to help with washing, shopping etc

3 - A breakdown of the average costs of care - at a glance

Average cost per week

Agency hourly care £20

Curam hourly care £13 - £17

Agency live-in care £650 - £1,600

Curam live-in care £800

Overnight agency sleeping care £180

Overnight Curam sleeping care £90 - £120

Residential care home £696 - £849

Nursing care home £969 £1,075

4 - Where to start with funding care

How do I Pay for Care at Home?

Paying for care is complex and most people are expected to contribute. At first glance, paying for live-in care or residential care might seem unaffordable. Thankfully however, there are many ways to access financial support.

There are four main financial support options:

• Local Authority funding you can access

• Benefits you’re entitled to

• NHS funding you’re eligible for

• Personal savings and assets

Financial Assessment for care at home

A Financial Assessment is a free service that will determine what you are obliged to pay towards the cost of your care. The financial assessment is organised by your Local Authority and will usually occur after the care needs assessment.

To calculate what contribution you and/or the local authority will make, the financial assessment will look at:

• Income - benefits and earnings

• Pension

• Savings - including joint accounts

• Property - including overseas

It’s important to remember that giving away property or gifting money to family, may still be included in your assessment. If the council suspects you have deliberately depreciated your assets in this way, it may stop you accessing funding altogether.

Will I have to sell my home to pay for care?

Your local authority will look at all your assets (property, savings, homes) to work out funding for care costs. This is a common question and the short answer is:

NO - If you need care to remain in your own home or your partner co-owns your house and lives there with you, the value of your property will not be assessed.

YES - If your care plan recommends a permanent place in a care home or nursing home, then the value of your property will be considered.

What happens after a Financial Assessment?

Your council will write to you with the results of your financial assessment. This is called your personal care budget. It will outline what care you have to pay for, and what support you are eligible for.

You have the option to receive your funding as a direct payment. This puts you in control of how you spend it - in home carers, care homes or alterations to your property - and is often more cost effective. Alternatively, the council will bill you for care they organise on your behalf.

Local Authority Funding for care at home

Most people contribute to the cost of their care and the thresholds are low.

• £14,250 - if you have less than this in assets and savings, the Local Authority will fund your care.

• Up to £23, 250 - the council will fund some, you will pay the remainder.

• Over £23,250 - you will be expected to pay for your care this is called ‘self funding care’.

Do your research, seek financial advice and keep consistent and clear when navigating the process. It can feel like a bureaucratic box-ticking exercise.

If you disagree with the outcome - you are entitled to appeal the decision. Stay informed to stay in control. Your Local Authority will form their decision based on the legislation outlined in the Care Act 2014.

Will The NHS fund my care?

You may have heard of NHS continuing healthcare. But who qualifies for this funding is complex. If you qualify, it will cover all your care costs.

• Who is it for? Generally, it’s for adults with certain long-term, complex health needs. Eligibility for NHS continuing healthcare is decided on your assessed needs, not on a particular diagnosis or condition.

• Who decides? A multidisciplinary team of healthcare professionals will assess your eligibility. This is a two part process. An initial checklist will decide if you need a full continuing healthcare assessment. This doesn't ensure you qualify for NHS funding but it is your opportunity to present your case.

• Where can I receive it? NHS continuing healthcare can be provided in home or through a nursing/ care home setting. You have a say and will work with a team to plan your care.

• You can investigate this option alongside your care needs assessment. Speak to your GP about getting a copy of the NHS Continuing Healthcare Checklist so you can better understand the criteria.

What is Self-Funding Care?

Your care needs assessment may have concluded you must self-fund all or part of your care. Although this might feel daunting, there are many private care companies and agencies across the UK who are able to provide hourly, live-in, respite or overnight care.

There are three main areas of self-funding care:

• Paying for home care

• Paying for residential care

• Paying for nursing care

How does Self-Funding Care work?

Your individual care needs will determine the costs involved. Most people prefer to receive live-in home care, or have regular hourly carers throughout the day and overnight. Compared to a residential care home, live-in care can save you around a quarter on the associated costs.

How do I find a carer?

Searching for a reputable, trusted carer is simple. To start, your Local Authority will be able to provide a list of agencies and care companies they work with.

Curam currently works with multiple councils across the UK providing in-home care. Ask friends and relatives if they have recommendations and check charitable organisations such as Age UK.

Consider this when finding a home carer:

• Are they self-employed or with an agency? Agencies often charge £20 an hour, yet the carer will receive as little as £9 an hour from that fee.

• Are there contract fees? Or joining fees?

• Are they vetted, DBS checked and qualified?

• How experienced are they? Curam carers have on average 10 years experience caring, demonstrating skill and talent in care.

• Are they insured?

• Do they have transport available?

• Do they have specialist skills which will support your care? Such as palliative, Alzheimer’s and dementia experience?

• Will you see a regular carer, or will they change? Self-employed carers through Curam are chosen by you, so become a regular and familiar part of your life.

Can I release equity to fund my care?

Live-in care can be a long-term care requirement. Considering equity release to fund it, is sensible but know the risks before you go ahead. Seek professional advice from an independent financial advisor. Look for one with a CF8 qualification - this means they can advise on care products and financing options.

If your home is mortgage free, or you have built up significant equity through mortgage payments, then you can release some of these funds to pay for live-in care. Equity can be released through lump sums, regular payments or as a loan against the property.

Before you consider equity release, ensure you have completed a care needs assessment and investigated if you qualify for NHS continuing care. You may be eligible for funding from other sources.

Benefits of releasing equity to fund care

• Allows you to use the value of your property to receive care at home

• Flexible financing options to suit different levels of care needs

• Can fund care until end of life

Disadvantages of releasing equity to fund care

• If you move into a residential care home, the value of the loan must be repaid in full

• Depending on the loan type, your beneficiaries may be liable to cover outstanding costs

Check your chosen equity release provider is a member of the Equity Release Council and can provide a ‘no negative equity guarantee’ which safeguards your relatives being liable for the loan once you’ve passed on. Find out more through The Money Advice Service.

What benefits are available for Self-Funded Care?

Not all benefits and allowances are means tested, so you might be entitled to them regardless of your savings and income. It’s always worth investigating your options as thousands of people are unknowingly eligible, and never claim.

• Attendance Allowance - up to £86.50 a week.

• Disability Living Allowance (this is being replaced by PIP).

• Personal Independence Payments (PIP) - daily living up to £86.50 a week, mobility up to £62.55.

• Armed Forces Independence Payment.

Your spouse, or family member, may be able to claim a Carers Allowance of £67.60 a week if they spent at least 35 hours a week caring for you.

Other benefits may come from your Local Authority. If you’ve had a means tested financial assessment your council will outline which you qualify for. Be aware - it is your responsibility to then apply.

• Universal Credit which now includes Housing Benefit and Job Seekers Allowance.

Claiming everything you are entitled to is wise, as it will help your savings and income last longer to cover the cost of care.

How do I employ a carer?

Living independently is not always an option the older and more frail we get. Thankfully, with a self-employed carer you can remain in control of your care.

• If you qualify for Local Authority funding, you can opt for direct payments - giving you the freedom to spend your care funding where you see fit.

• If you are self-funded, then a live-in or hourly carer can save you thousands on the cost of your care.

A residential care home might be suitable in the future, but for those with less complex care needs, a self-employed home carer has many benefits.

Benefits of receiving care at home

• Flexibility

• Lower costs

• Better Mental Health

• Personalised Care

• Overnight and respite care options

• Remain in contact with friends and family

• Domestic help

Planning your care early is wise, as you remain in control of the decisions involved. Research potential care options, speak to a financial adviser and ask friends and family for recommendations. Just know, help is out there.

Curam is a better care community. Join today and we’ll help you find the perfect care partner, just for you.

Vetted & approved carers

Vetted & approved carers

DBS checked & insured

DBS checked & insured

Back

Back